The Lessons of Ancient Entrepreneurship

The history of antiquity shows that evolution is not inevitably carried upward by economic or technological potential automatically realizing itself. Entrepreneurs have obtained surpluses through the ages, but often in ways that injure society as a whole.

Introduction

Past events make us pay particular attention to the future, if we really make thorough enquiry in each case into the past.

—Polybius (XII 25e, 6)

Mesopotamia’s lack of basic raw materials prompted military rulers like Sargon of Akkad to boast that they had extended long-distance commerce. By contrast, classical antiquity’s aristocracies sought local self-sufficiency (supplemented by foreign booty and tribute, to be sure). This became the condition into which the western Roman Empire sank as economic life retreated to landed estates, while prosperity lasted longer in Egypt and the eastern half of the Roman Empire ruled from Constantinople.

Mesopotamia Was the Real Mother of Modern Business

The fact that Near Easterners were the first to develop the basic repertory of business practices poses the question of what is distinctly Western. Classical Greece and Rome have long been depicted as representing a fresh start, in contrast to the allegedly stagnant Near Eastern economies. Yet the Near East enjoyed superior prosperity from the beginning to the end of antiquity, as well as better economic balance and stability. What has long been viewed as a fresh spirit of individualism turns out to be a product of the breakdown following the devastation that swept the eastern Mediterranean circa 1200 BC. The ensuing half-millennium brought a free-for-all that never developed an ethic of steering gain-seeking along productive rather than predatory and extractive lines.

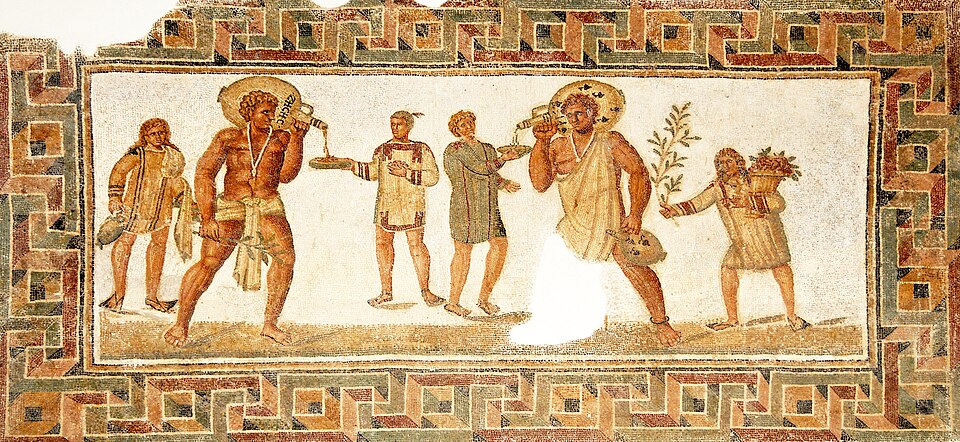

When Syrian and Phoenician merchants organized Mediterranean trade in the eighth century BC, they brought standardized weights and measures, money, a financial vocabulary, and interest-bearing debt to Greek and Italian communities. Local chieftains applied these practices in a smaller, more localized context that lacked the checks and balances found in the Near East to save economies from polarizing between creditors and debtors. There were numerous one-off debt cancellations under the 7th- and 6th-century tyrants, and Solon’s seisachtheia in 594 BC, but Greece and Rome never developed a tradition of annulling debts to prevent creditors from foreclosing on the land and reducing much of the citizenry to debt bondage. Just the opposite: Greece and Rome measured success by the ability of creditors to achieve social status through land ownership with its patronage power over tenants and clients. There was no attempt to justify wealth and property by attributing it to the labor expended by its owners. Land was obtained by inheritance or through foreclosure on the impecunious, or taken from the public domain by military conquest or insider dealing. Bondage became harsher and more inexorable, with more than a quarter of the Roman population falling into servitude by the fourth century AD, increasingly on large slave-stocked estates.

Economic Mismanagement, Exploitation, and the Fall of Empire

Rome’s economic history provides a leading example of Arnold Toynbee’s conclusion in A Study of History that the cause of imperial collapse invariably is “suicidal statecraft.” It also illustrates the contrast that economist William Baumol has drawn between productive and unproductive enterprise, with its foreign relations in particular aimed at extorting tribute and indebting local populations. The short time frame of Roman imperial administrators did not allow replenishment of the resources stripped from the provinces. And instead of promoting domestic market demand at home, Rome let debt service and taxes siphon off purchasing power and dry up commercial enterprise, and debased the coinage in a futile attempt to deal with the fiscal crisis that culminated in feudalism.

In these respects classical antiquity must be viewed as an unsuccessful mode of exploitation. Nobody voiced a program of raising general living standards, labor productivity or technology by developing a home market. Charity by the wealthy seemed the best that could be hoped for. It remained for John Locke and other Enlightenment political economists to justify property morally by the labor that went into its acquisition (an idea that, Locke acknowledged, applied only on the small scale of self-sufficient holdings). But for this labor theory of property value to apply, the political and fiscal context for enterprise had to be transformed.

After the Dark Age

A new world did emerge out of Rome’s collapse into a Dark Age. The transition from slave labor via serfdom to free labor transformed the social character of enterprise. Commerce began to revive with the Arab and Moorish trade across southern Europe to Spain. In 1225 the looting of Constantinople by the Crusaders, financed by the Venetians as a paying venture for a quarter of the loot, drew vast sums of monetary bullion into western Europe. It was enough to provide the basis for an expansion of credit. The Scholastics permitted loopholes to the Christian ban on usury for bankers to charge interest in the form of agio on foreign payments, mainly to finance trade—along with royal war debts.

It was in the late medieval period, and more so during the Renaissance and Enlightenment, that economic gain-seeking took the form of expanding production. Trade became the means of obtaining the monetary metals, and credit came to be monetized on the basis of national treasuries and central banks. Bankruptcy laws became more humanitarian and debtor-oriented, at least until quite recently.

The Dead Hand of the Rentier Ethic

The history of antiquity shows that evolution is not inevitably carried upward by economic or technological potential automatically realizing itself. Entrepreneurs have obtained surpluses through the ages, but often in ways that injure society as a whole. Predatory loans mounting up to strip capital, and economies living in the short run by asset stripping, are universal deterrents to long-term investment. Many vestiges of the rentier ethic that culminated in the post-Roman feudal period are still with us, weighing on the present like a dead hand (lit. mort-gage). Much as classical antiquity plowed its commercial gains and the extraction of interest into the land, many enterprises today find land (along with financial speculation and corporate takeovers) more attractive than new capital formation.

Modern observers have criticized Rome’s legal framework for not replacing commercial partnerships with permanent limited-liability joint-stock companies. Trading profits had to be paid out each time a partner died or a new one joined, and often at the end of each voyage. But today’s stock-market raiders appear to be reverting to the short-term perspective that historians have blamed for blocking Rome’s economic takeoff.

The Future of Successful Enterprise

The economic environment that most effectively contributes to prosperity is one that induces entrepreneurs to gain by investing in new means of production, not by rent-seeking, redistributive property expropriation, debt foreclosure and insider dealing. Successful enterprise helps economies grow by contributing to output, or adding to efficiency by innovations that minimize costs, not by a proliferation of debt and property claims.

The moral is that the race is not always to the strong or economic victory to the most productive. The economic course of civilization has not always been upward, as historians who focus more on technology than on the institutions of credit and property tend to imply. That is the main lesson taught by a review of the history of enterprise, positive and negative, over the course of antiquity.