These U.S. Banks Are Financing Climate Chaos Through Fossil Fuel Expansion

Wall Street’s dirtiest secret is how fossil fuel expansion depends on Big Bank finance.

Introduction

We’ve heard lofty net zero promises over the last year from the top U.S. banks – Bank of America, JPMorgan Chase, Citi, Wells Fargo, Morgan Stanley, and Goldman Sachs.

But don’t be fooled: These six banks continue to finance climate chaos through their support of companies like Exxon, Saudi Aramco, BP, Shell, TotalEnergies, and Venture Global. These are among some of the top companies expanding fossil fuels globally. Net zero promises are meaningless without a commitment to ending fossil fuel expansion. There’s no room in the global carbon budget for any new fossil fuel extraction or infrastructure. We don’t need new oil wells, gas fields, pipelines, LNG import/export facilities, or power plants.

Net Zero by 2020

In 2021, the International Energy Agency (IEA) issued its “Net Zero by 2050” report, which made clear that if we’re to keep global warming below 1.5°C, there can be no new fossil fuel build-out beyond projects that reached Final Investment Decision (FID) in 2021.

In the IEA’s climate scenario—and every other credible climate scenario aligned to limit warming to 1.5°C—fossil fuel expansion ends now, and we immediately begin phasing out fossil fuel resources already in use.

IEA’s Net Zero by 2050 report highlighted what we already know from the frontline and Indigenous communities who have been fighting fossil expansion for decades: Keep it in the ground.

Wall Street’s Dirtiest Secret

Our 2022 report, “Wall Street’s Dirtiest Secret: How Fossil Fuel Expansion Depends on Big Bank Finance,” takes a close look at what exactly the Big 6 U.S. Banks are financing.

Since the Paris climate agreements went into effect in 2016, the Big 6 U.S. banks have provided $445 billion in financing to the top 100 companies expanding in oil, gas, and coal globally.

Financing by JPMorgan Chase, Bank of America, Citi, Wells Fargo, Morgan Stanley, and Goldman Sachs accounts for 33% of the $1.3 trillion in funding provided to those companies by the 60 biggest banks globally by assets.

Examples

ExxonMobil & Bank of America

ExxonMobil has received $55.8 billion in financing from the Big 6 U.S. Banks since 2016. Exxon is engaged in a massive expansion of fossil fuel extraction.

ExxonMobil is exploring for new fossil fuel reserves, developing new reserves, and building new infrastructure to process that fuel. Amongst the largest companies globally, the company is developing 4% of all new reserves, including oil offshore of Guyana, fracking in the Southwestern U.S. Permian Basin, and LNG in Mozambique.

In every one of these places, they face community opposition. They’re making huge profits at the cost of human health, fragile environments, and our shared climate. Exxon is Bank of America’s #1 fossil fuel client. They gave them $1.1 billion in financing just in 2021, bringing their total since the Paris Agreement to $15.3 billion.

Venture Global & Bank of America, JPMorgan Chase, Morgan Stanley, Goldman Sachs

Venture Global is a new player aggressively building out LNG infrastructure in coastal Louisiana. Since 2019, the firm has garnered $4.5 billion in financing from Bank of America, JP Morgan Chase, Morgan Stanley, and Goldman Sachs.

Venture Global began operating the Calcasieu Pass LNG facility in January 2022, located on formerly pristine wetlands near the Sabine National Wildlife Refuge.

Local activists have documented near-constant flaring and under-reported accidents at this new facility (LNG is 95% methane—a powerful greenhouse gas and pollutant).

Venture Global is developing three more LNG facilities in southwest Louisiana. If completed, the estimated annual greenhouse gas emissions for these four terminals would be 447 million metric tons of CO2 emissions a year, the equivalent of 120 coal-fired power plants.

A Vicious Cycle

These facilities are not only contributing to climate change, they’re also vulnerable to its impacts.

Proposed terminals are sited on some of the most precarious land on the gulf coast—land that has flooded five times since 2005 during every major hurricane.

Human Rights Issues

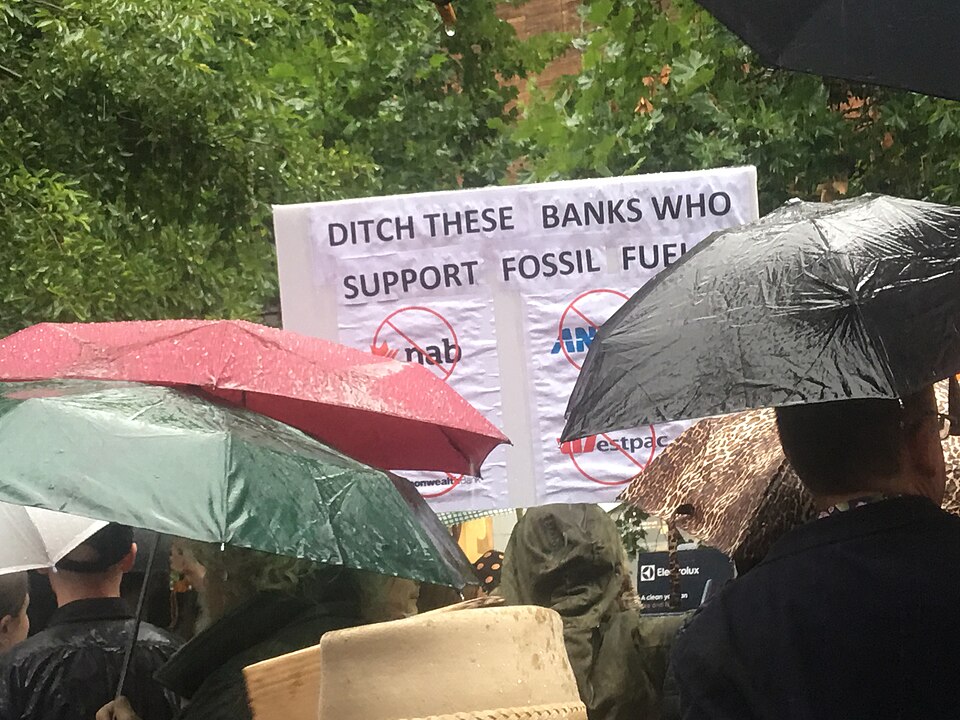

Whether it’s offshore oil in Guyana or LNG export terminals in the Gulf Coast, we are hearing from our frontline partners that fossil fuel expansion runs roughshod over human rights.The frontline communities in the U.S. Gulf Coast call on banks to put their money where their pledges are: Stop financing fossil fuel expansion.

Take Action

Banks have a historic opportunity to facilitate a just transition. To do that, they must get serious about phasing out fossil fuels. A necessary first step is to end their support for fossil fuel expansion and the companies carrying it out.

Sign the petition calling on the Big 6 U.S. Banks to end all financing for fossil fuel expansion now and #DefundClimateChaos.