Are Western Oligarchies a Long Detour of Civilization?

There are alternatives to leaving society to the mercy of predatory wealth-seeking individuals—one example is Bronze Age Mesopotamia.

Introduction

Bronze Age rulers had no free-market advisors to argue against managing the money and credit system as a public utility. Rulers recognized the ever-present tendency for economies to be destabilized by debt when floods or drought, war, disease or personal misfortune prevented cultivators from paying the debts that accrued during the crop year. But modern economic ideology, like Rome’s pro-creditor legal philosophy, insists on the “security of contracts,” above all for debt liabilities. Today’s economic orthodoxy rejects acknowledging that the exponential dynamics of debt leads to oligarchy if governments do not intervene to write down debts.

Profiteering Financial Centers Are Antiregulation

Neoliberal policy deems deregulation and privatization to be synonymous with democracy, human rights and prosperity. Francis Fukuyama helped popularize the belief that this convergence is an inherent evolutionary dynamic of history. Liberalism advises governments to stand aside and not regulate (“interfere with”) the free market. In practice that means leaving economic planning in the hands of financial centers, whose business plan is to make money by establishing financial claims and rent-extraction privileges (literally “private law”) on society at large.

Oligarchy Leads to a Polarized Economy

Oligarchies through the ages have demonized public oversight so as to privatize the land’s economic rent by predatory wealth-seeking taking land and credit out of the social and fiscal context in which it originally emerged in archaic economies. Modern economies are polarizing as their debt burden transfers income and property from debtors to the financial sector, while other rentiers extract economic rent through privatized infrastructure, natural resources and other monopolies. Banks lobby to protect such rent extraction, seeing that most land rent today is paid as interest. Creditors now end up with more rent than the tax collector.

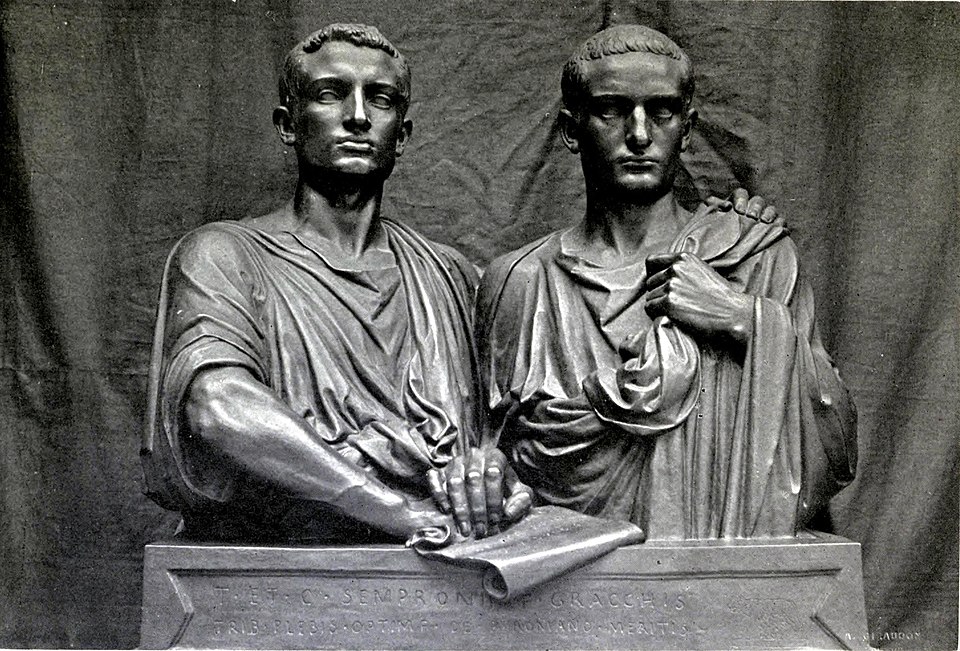

Oligarchy Was the Blight of Antiquity

So we are brought back to how deregulation of credit and the ensuing monopolization of land and other wealth has led to ancient Greece’s “oligarchized democracies” and the creditor-landowning oligarchy that destroyed Rome. Its own historians blamed the destruction of the Republic on Rome’s oligarchy monopolizing the land, and opposing debt relief and land redistribution, leading to economic polarization and austerity that prevented Rome from creating prosperity from within. Its collapse was a forerunner of the economic polarization caused by modern pro-creditor laws that produce the same effect of concentrating property and control of government in financial hands.

An Ancient Alternative

The Bronze Age’s management of credit and debt shows that there is an alternative to the “sanctity of debt.” Near Eastern rulers recognized that economic resilience requires treating the monetary, banking and credit system as a public utility, along with land. The Western path was for private-creditor power to lead to oligarchy dismantling public authority and impoverishing society. Avoiding that dynamic was the great achievement of the Near Eastern economic takeoff and its tradition of Clean Slates.