The Mesopotamian Origin of Debt

Many of our modern financial constructs were invented in Bronze Age Mesopotamia. One of these was interest-bearing debt.

Introduction

The spirit of the Western world, so we are told, is one of progress and ongoing economic transformation. Such progress, in the modern mind, necessarily involves what the political economist Joseph Schumpeter characterized as “creative destruction” by ambitious wealth-seekers who drive society forward.

In this model, the overgrowth of debt leading to financial austerity and economic polarization is an inherent feature flowing from the dynamics of unchecked interest-bearing debt. History disproves this. Bronze Age societies, for example, viewed the overgrowth of debt not as an inherent feature but as an anomaly. In fact, they felt compelled to avoid it, deliberately prioritizing overall economic growth and resilience over financial gain-seeking by periodically proclaiming Clean Slates.

When the Mesopotamian economic model moved, the concept of Clean Slates was left by the wayside. Greek and Roman oligarchies devoted themselves to accumulating wealth at the expense of increasingly immiserated populations. Inevitably,

By examining the way debt developed, the way different societies have managed it throughout history, and how such management affected those societies, we may be better equipped to navigate economic crises in the present.

Mesopotamian Origins of Credit and Interest

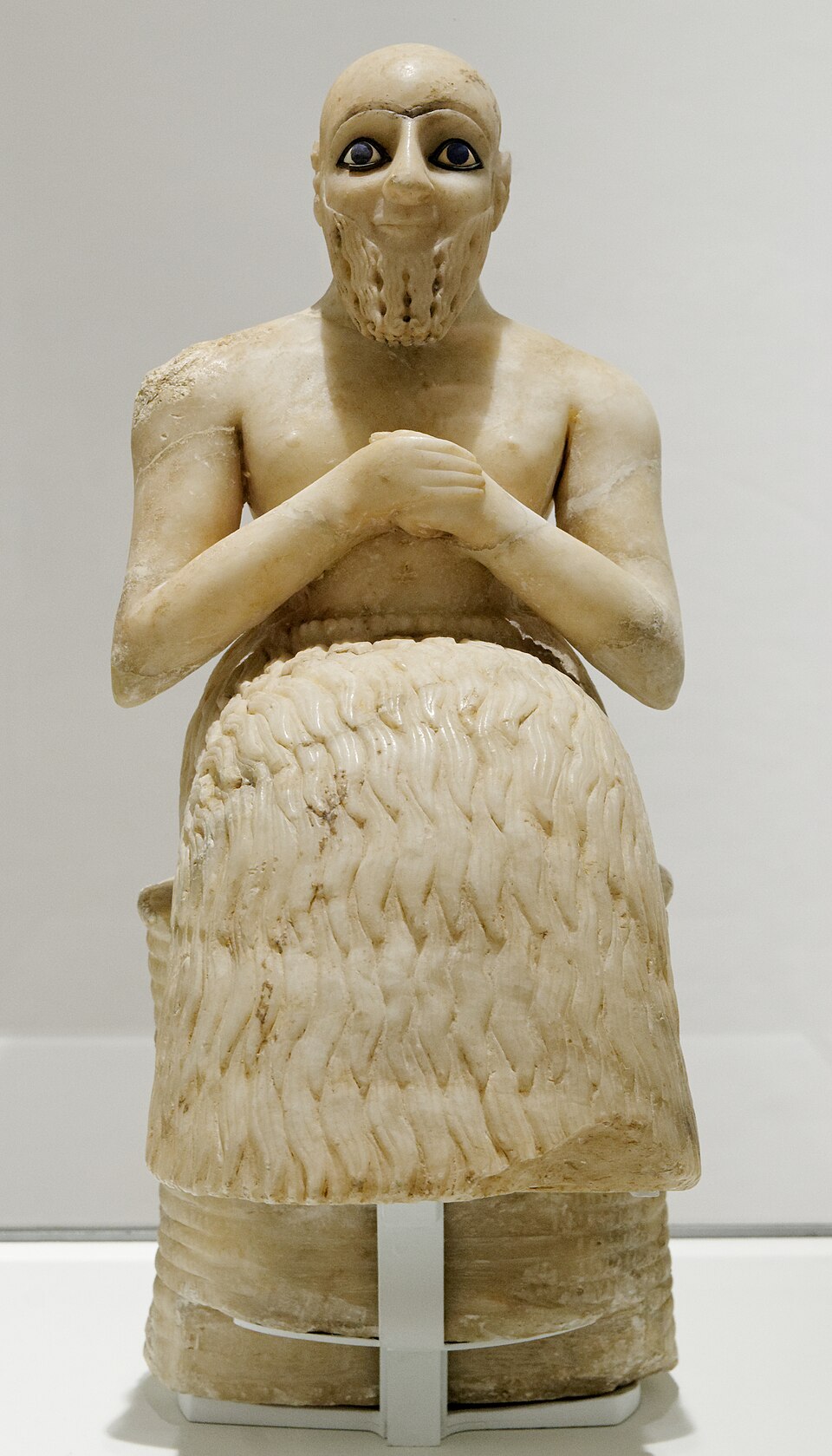

Interest-bearing commercial and agrarian debt was incorporated into civilization’s economic structure in the third millennium BC in Mesopotamia, the fertile area between the Tigris and Euphrates river system.

What made Mesopotamia unique was its need for foreign raw materials on a scale much larger than that of any other society of the time. The only way to obtain metal, stone, timber, and other raw materials lacking in the region was to organize foreign trade. By doing so, the people of the Near East made financial innovations and new property relationships.

Arranging labor and long-distance trade at scale led to the standardization of measurements and payment. Temples developed a system of account-keeping, forward planning and resource allocation to organize the distribution of food and other products to the palace and temple staffs and for corvée labor projects on a regular basis. The administrative year was divided into uniform 30-day months and a sexagesimal (60-based) system of fractions was used to denominate weights and measures for monthly allocations. Money emerged as a byproduct of administered price ratios to quantify payments for transactions between the community and the temples and palaces. The silver shekel-weight’s value was set as equal to a “basket” of barley, and as accruing monthly interest of one shekel (1/60th) per mina when lent out, most paradigmatically for goods consigned to merchants on credit to trade abroad.

Temples became genuine centers of enterprise, employing war widows and orphans to weave textiles and create handicrafts, thereby creating a specialized labor force that formed a distinct sector of the economy. The temples consigned these goods to traders, creating rules for monetary exchange and credit for foreign trade.

The practice of charging interest probably arose as a means of financing long-distance trade in a way that provided the consigner (the palace or temples) with what was deemed to be a fair share of the mercantile gains—doubling the value of the consigned export goods in five years (at the usual commercial interest rate of 20 percent per annum in decimal terms).

Economic Life in Mesopotamia

Structuring markets and commercial enterprise required a critical social mass and the organizational and planning capacity provided by large institutions, first temples and then palaces. Social resilience required the economy to be managed as an overall system in order to prevent credit imbalances from destabilizing basic land-tenure relations.

Two categories of debt existed, each associated with its own designated monetary commodity. Business obligations owed by traders and entrepreneurial managers were denominated in silver. The agrarian economy operated on credit denominated in barley units, assigned a value equal to the silver shekel in order to strike a common measure.

Commercial Debts

Rules for money loans described in scribal training exercises are almost exclusively in the commercial sphere, especially in connection with long-distance trade. Interest-bearing debt rose in this environment, taking the form of advances of assets by the large public institutions to entrepreneurial recipients, enabling them to make an economic gain in commerce and land management.

These loans were denominated in silver at the equivalent of a 20 percent annual rate of interest, doubling the principal in five years. Under normal conditions merchants were able to pay this rate to their creditors and keep a profit for themselves. Lenders shared in the mercantile risk, taking what in effect was an equity position. If caravans were robbed or ships and their cargoes lost at sea through no fault of the merchant, the debt was voided. There is no indication that payment of such mercantile debts led to problems requiring royal intervention.

Agrarian Debts

Throughout all antiquity the debts that most disrupted the economy’s fiscal and social balance were in the agrarian sphere. Agrarian debts mostly arose on rental agreements on land advanced by public institutions to intermediaries, who then subleased it to sharecroppers. Initially, land and workshops were administered directly by palace officials in Ur III (2111-2004 BC), but by the Old Babylonian period (2000-1600) the palace franchised the management of its fields and date orchards, herds of sheep, brick-making workshops and other handicrafts to “entrepreneurs” as Palastgeschäfte, “royal enterprises.” These managers were entitled to keep whatever they could produce or collect above and beyond the amount stipulated by their contract with the palace, but if the sums they collected fell short, their arrears were recorded as a debt and they were obliged to pay the difference out of their own resources.

So rural usury emerged as well-to-do “big men” charged for arrears owed to the palace and temples, also lending food and other necessities to distressed cultivators. But agrarian interest-bearing debt, especially usury charged to borrowers in need, was always denounced as socially unfair.

The rate of interest payable by cultivators on such debt arrears was one third, the same as the rate charged for advances of sharecropping land. Cultivators were also charged this one-third rate of interest for unpaid arrears of charges for advances to buy food, beer or meet emergency needs on credit. If they lacked the means to pay out of whatever assets they had, they had to work off the debt charges in the form of their labor service or that of their family members (daughters, sons, wives or house-slaves), and ultimately they had to pledge their land rights.

Clean Slates

For thousands of years, rulers in the Near East from Babylonia to the Levant recognized that for society to survive, they needed to help their indebted citizens recover their financial solvency. After all, the original objective of charging interest to sharecroppers and other cultivators can hardly have been to reduce them to bondage or to expropriate them from their self-support land. Their labor was necessary for the agrarian economy to function; without mutual aid, low-surplus economies suffered a flight of the population or civil warfare. To prevent this, rulers forgave personal debts.

Kings also wanted to stop creditors from permanently prying away the palatial sharecropping rents and corvée labor services of smallholders who had fallen into debt. They anticipated this incipient rivalry with creditors by periodically annulling agrarian debts. These Clean Slates protected the palace’s fiscal needs and its control of labor service and crop rents, and maintained widespread self-support for the citizenry on the land.

Clean Slates cancelled debts, liberated debtors from bondage, and returned to them the self-support land that they had lost. So the societies in which interest-bearing debt was first developed addressed the accompanying problem of creditor claims on income and property tending to exceed the ability to pay. This problem has confronted economies ever since but rarely has it been solved so effectively. The disruption of personal liberty and land tenure was kept fairly temporary for thousands of years throughout the Near East by the practice of Clean Slates.

Traditional Social Values

Archaic societies had particular values and concerns that inevitably shaped their economic practices.

Their social ethic was much like that of today’s low-surplus communities in viewing large personal [KD4] wealth as a threat to social balance. Early civilizations used regulatory oversight to subordinate selfishness and promote overall welfare. Maintaining resilience in an environment subject to crop failures from bad weather, pestilence and warfare required institutionally shaped “market forces” to cope with the strains that resulted from agrarian debt that threatened to lead to permanent bondage and appropriation of land by creditors.

Crucially, land tenure was viewed as a natural right. Land was still a public utility, a precondition for labor’s freedom of self-support, not yet permitted to become a choke point for landlords to permanently reduce debtors to bondage and gain control of their labor and extract crop rent for themselves. Labor was the scarcest resource.

Hierarchy was a fact of life: everyone was subject to some higher authority. Keeping creditors subject to royal intervention (in the form of debt forgiveness) was not a radical act but conservative prudence on the part of Bronze Age monarchies; their hierarchal authority rested on their success in preserving stable social relations to maintain military strength and economic viability.

Liberty, to the archaic mind, meant freedom from slavery. Sumerian amargi, Babylonian misharum and cognate royal Clean Slate proclamations restored the “mother condition,” an idealized “straight order” as a customary norm in the form of freedom of citizens from debt bondage except on a limited temporary basis to work off their debts. (Only foreigners were slaves, mainly captured mountain girls.) That was a basic element of the archaic social contract. To regularly restore this condition—along with the palace’s fiscal revenue—every ruler in Hammurabi’s Babylonian dynasty annulled agrarian debts upon taking the throne, and when war, crop failure, outbreak of disease or similar “acts of God” (Enlil, Babylon’s Storm God) called for such intervention.